UGANDA, Kampala | Real Muloodi News | The newly proposed increase in capital requirements for banks by the Central Bank of Uganda has been met with mixed reactions by the industry experts and stakeholders.

The central bank’s new proposal targets to increase the paid-up capital by the financial institutions from the current USh 25 billion to USh 150 billion, credit institutions from USh 1 billion to USh 25 billion, and MDIs from USh 500 million to USh 10 billion. It is aimed at streamlining the sector and bringing it up to speed to catch up with its regional peers.

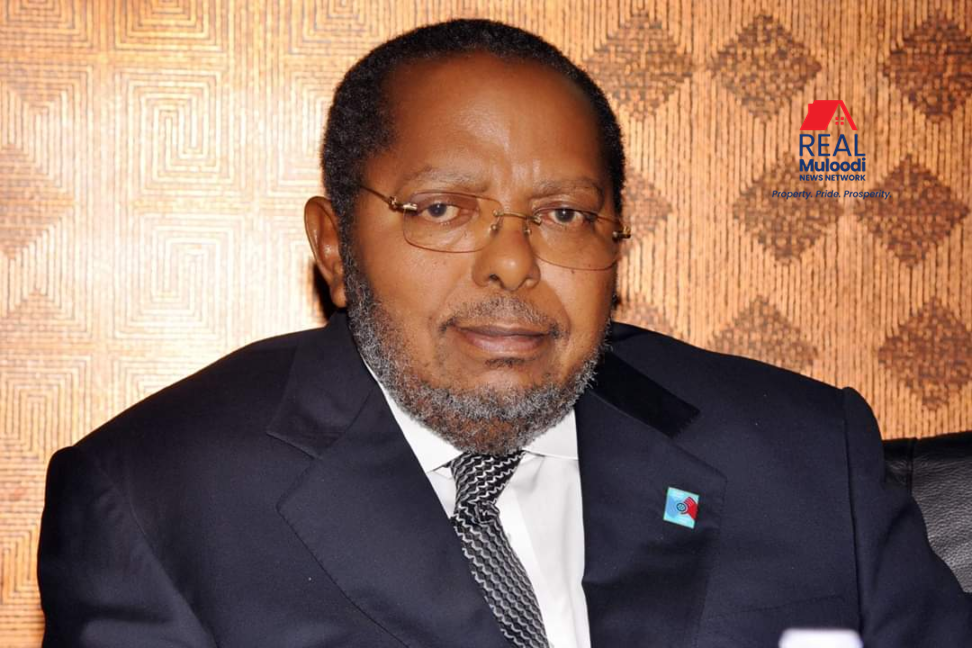

“…the increase in paid-up capital is long overdue and should match the dynamism in the economy, reward shareholder commitment, and enable institutions to withstand shocks and to converge with regional peers among whom Uganda effectively has the lowest paid-up capital,” said Tumubweine Twinemanzi, the director of supervision at BoU, in a statement.

In regional caparison, Uganda falls far behind its peers. Rwanda has capped her capital requirement at US$35m (Shs123bn), South Sudan at US$30m (Shs105bn), Zambia at US$100m (Shs350bn) for foreign banks, and US$50m (Shs175bn) for local banks and Ghana at US$100m (Shs350bn) respectively.

However, Stephen Kaboyo, the ex-Bank of Uganda executive and now the managing director at Alpha Capital Partners, expressed his support for the new move without fear of danger for minor players.

“The proposed capital levels will put pressure on small banks to merge or exit the market as regulation is always costlier to minor players than the big ones,” he said.

According to financial statements for the year ended December 2020, 15 commercial banks fall below the proposed new capital requirement. This is 60% of the total commercial banks in the country.

If the proposal is implemented, some fear that those businesses unable to raise the capital to meet the rule will either merge or be forced out of the market. Some players are already struggling to keep up with the current capital requirements.

Wilbrod Owor, the executive director at the Uganda Bankers Association, said that it is because of the likely risks to the industry that they have consultations.

He said there are already suggestions to the Bank of Uganda on how to move on, including; giving timelines for banks to raise the required capital by staggering it in years, creating tiers for banks basing on their capital base, and other indicators like cash and kept earnings.

However, the proposed new capital requirements have already been met with a favourable reception by some big players.

“As a supervised financial institution, we have a reputation for complying with all central bank regulations; if this proposal passes, Stanbic Bank will undoubtedly comply with it. Our view is that it is a good proposal as it fortifies financial institutions from shocks such as those caused by the COVID-19 pandemic. The proposal is also a good thing for customers as it would enable banks to do more,” said Anne Juuko, Chief Executive, Stanbic Bank Uganda.

Fabian Kasi, the managing director of Centenary Bank, also said that although he supports the proposal, the banks need ample time to meet the capital requirements because they are not a threat to the financial sector.

Kasi also added that his team is ready to ‘shop’ any player that fails BoU’s capital requirement test.

READ MORE LIKE THIS: