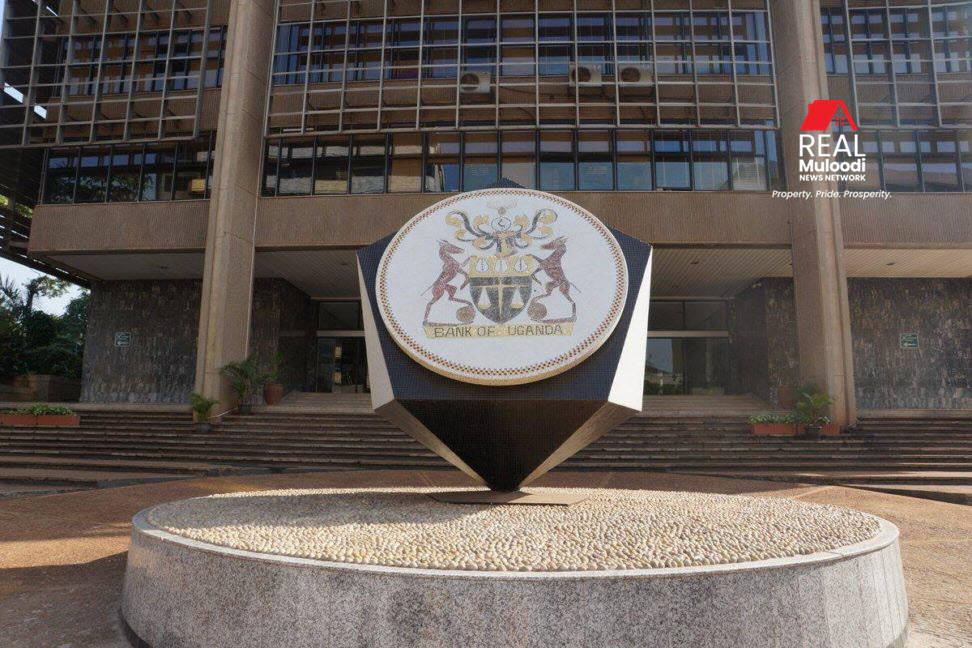

UGANDA, Kampala | Real Muloodi News | UPDATE: April 13, 2022: The Bank of Uganda left its benchmark interest rate at a record low of 6.5% at its April 12, 2022 meeting to continue supporting the economy despite ongoing inflationary pressures.

Original Article, April 11, 2022: The Russia-Ukraine invasion which started on February 24, 2022, has triggered a global economic chain reaction that has not spared Uganda. Financial analysts have suggested that if the trend persists, it would be prudent for the Bank of Uganda to deploy a monetary policy to increase interest rates.

Records from the Uganda Bureau of Statistics (UBOs), indicate a northward rise in inflation currently standing at 3.2% as of March 12, 2022.

The invasion has seen Uganda, just like other economies, get hit with escalating prices of daily essential consumable commodities that include fuel, food crops, and processed foods, among others. The economic impact is enormous.

A move to increase interest rates would be designed to keep the surge in inflation in check, and mitigate the ripple effect it would otherwise impose on the economy

The central bank says there is no immediate cause for alarm, because even though Uganda’s 3.2% inflation rate is the highest recorded by the Uganda Bureau of Statistics since June 2020, as it remains under the projected 5%.

The financial analysts gave their opinions recently at the ABSA Africa Financial Markets Index 2021 and the Economic Outlook.

In February 2022, during the Bank of Uganda monetary policy briefing, the bank’s Deputy Governor Michael Atingi-Ego explained that the central bank had taken a wait-and-see approach.

“If the exchange rate were to depreciate significantly, partly on account of higher demand for foreign currency and monetary policy tightening in advanced countries, this would increase the overall inflation pressures and foster a need for tightening a monetary policy going forward,” Atingi-Ego explained.

Chief Economist ABSA Group Jeff Gable, observed that the central bank should strike a delicate balance and act at the opportune time.

“We expect that interest rates are likely to rise. When that will happen and by how much is a real question mark because of the huge uncertainty created by the global environment in Russia and Ukraine,” Gable observed.

The Permanent Secretary of the Ministry of Finance, Planning, and Economic Development Ramathan Ggoobi described the economic turbulence resulting from the Russia-Ukraine invasion as a “temporary shock” that would soon return to normal.

The central bank deploys a raft of measures for price control. What awaits to be seen is the central bank’s increase in interest rates in relation to the commercial banks’ decisions.

The largest economy in the world; the United States of America, has already deployed measures to counter inflation. America’s inflation is at its highest in 40 years following the onset of the Russia-Ukraine invasion.

Greg McBride, Chief Financial Analyst at New York-based consumer financial services firm Bankrate, explained that the Federal Reserve Bank uses a balancing act to keep things at bay.

“The Fed uses interest rates as either a gas pedal or a brake on the economy when needed,” McBride explained.

On March 16, 2022, the Federal Reserve Bank was compelled to take swift action on interest rates. The last time such a decision was made was in 2018.

READ MORE LIKE THIS:

Museveni Orders Suspension of Uganda Land Commission Bosses, Calls for Investigation