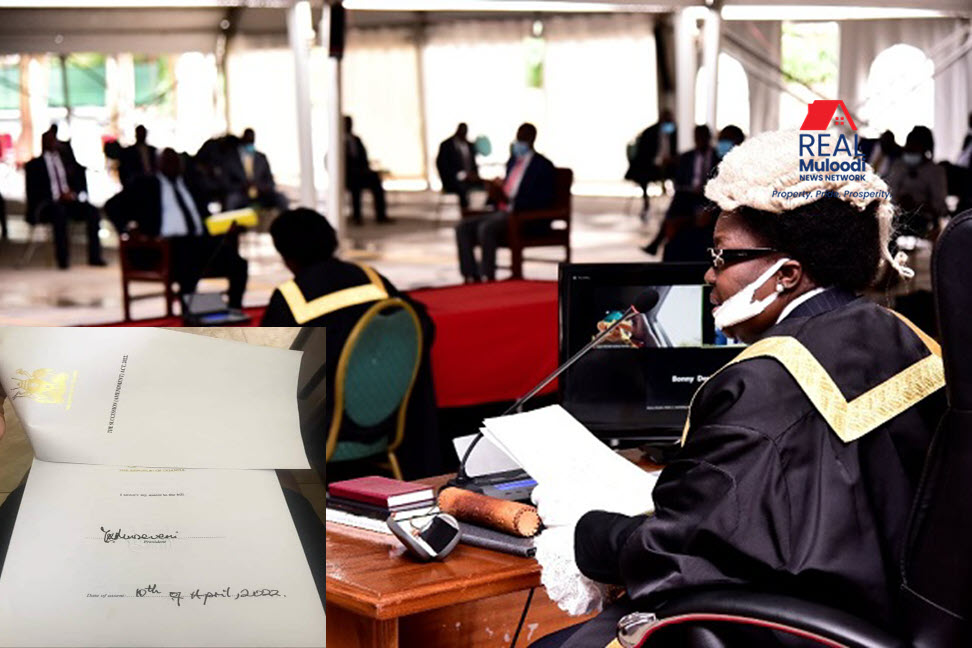

UGANDA, Kampala | Real Muloodi News | President Museveni signed the Succession Amendment Bill 2022 into law on April 10, 2022, which had been passed on 8th February 2022.

The measure was first introduced in Parliament in March 2021, intended to repeal the existing succession statute enacted in 1906, and to ensure equality and equity in the transfer of the estates of the deceased.

When the bill was initially presented to the president for assent in April 2021, he declined to assent to it because of a new provision introduced to settle management of an estate where a person dies in intestate, that is, without a legal will. In such cases, the surviving spouse would receive 80 per cent of the deceased’s estate, whereas dependent relatives would inherit the remaining 20 per cent.

President Museveni sent the Bill back to the House of Parliament, instructing the Members of Parliament to “reconsider” the instate provision. The president argued that the provision departs from earlier provisions of the law, without clear justification. Further, he argued that the provision, which he sees as unfair to dependent relatives, would create disharmony between the relatives and the surviving spouse.

A spouse is a husband or wife married under Ugandan law or under the laws of another nation and whose marriage is recognised as legal in Uganda.

The Succession Amendment Law Highlights

The newly enacted legislation expands the provision of distribution of property of an intestate to apply to both male and female dependents as well as to spouses in a marriage. This is an amendment to Section 27 of the Succession Act.

According to the new legislation, upon the death of a surviving spouse, the residential holding or any other residential holding shall devolve to the lineal descendants equally, who shall occupy it subject to the terms and conditions set out in the Second Schedule to the Act.

A person who evicts or attempts to evict a surviving spouse, lineal descendant or dependent relative who is entitled to occupy the residential holding or any other residential holding commits an offence and is liable to a fine not exceeding one hundred and sixty eight currency points, which is equivalent to 3.36 million Shillings or imprisonment not exceeding seven years or both.

Sections 29 and 30 deal with intestate distribution, which stipulates that an intestate’s estate, save for his or her residential holdings or other residential holdings, should be distributed among the following classes: by a spouse, a lineal descendant, a dependent relative, and a customary heir.

The spouse will get 20%, dependent relatives will receive 4%, lineal descendants, 75%, and the usual heir will receive 1% of the intestate’s inheritance.

When an intestate leaves no surviving spouse or dependent relative, the lineal descendants receive 99% of the estate, while the usual heir receives 1%.

If the intestate has a spouse, a dependent relative, and a customary heir but no lineal descendant, the spouse receives 50% of the intestate’s property, the dependent relative receives 49%, and the customary heir receives 1%.

If the intestate has a customary heir, a spouse, or a dependent relative but no lineal descendant, the customary heir receives 1% of the intestate’s property and the surviving spouse or dependent relative receives 90%.

If the intestate leaves no survivor other than a customary heir capable of claiming a share of his or her estate, the inheritance is divided equally among the relatives closest in kinship to the intestate.

The spouse who remarries before the deceased’s estate is divided is entitled to the part he or she would have been entitled to under subsection (1).

If the customary heir is also a lineal descendant of the intestate, the customary heir is entitled to share as a lineal descendant in addition to his or her part as a customary heir.

A spouse or lineal descendant of an intestate who occupies a principal residential property or any other residential property under section 26 is not required to take that occupation into account when determining any share of the intestate’s property to which the spouse, lineal descendant, or child may be entitled under section 27.

If the surviving spouse was separated from the intestate as a member of the same household when the intestate died, the surviving spouse has no claim to the intestate’s estate.

Also, Section 1, which provides for the distribution of the deceased’s property, shall not apply if: the surviving spouse was absent at the time of his or her death, or the deceased was separated from the surviving spouse because of divorce or the intestate is the cause of the separation.

Despite subsection (1), the court may, for good reason, decide that subsection (1) does not apply to a surviving spouse on an application filed within six months of the intestate’s death by or on behalf of the surviving spouse.

Regardless of the surviving spouse’s separation from the intestate as a member of the same household, a child or lineal descendant sired by the surviving spouse and the intestate is entitled to profit from the intestate’s estate.

The surviving spouse has priority over any other individual in the estate administration when selecting who may administer the deceased’s estate. However, if the Administrator-General determines that the surviving spouse is not a competent and appropriate person to manage the estate or that it is essential, under the circumstances of the estate, to assign administration to another person, her wishes may be ignored.

Under paragraph (1), a person who is given letters of administration shall govern the estate for no more than two years. The court may, however, extend the term if it is in the best interests of the beneficiaries to do so.

Click to access The Succession (Amendment) Act, 2022.

ADVERTISEMENT:

READ MORE LIKE THIS:

Legal Committee Starts Reconsideration of Succession Amendment Bill

Uganda Proposes 7-year Jail Term for Evicting Widows & Orphans

Re-introduction of the Real Estate Agents & Landlord and Tenant Bills