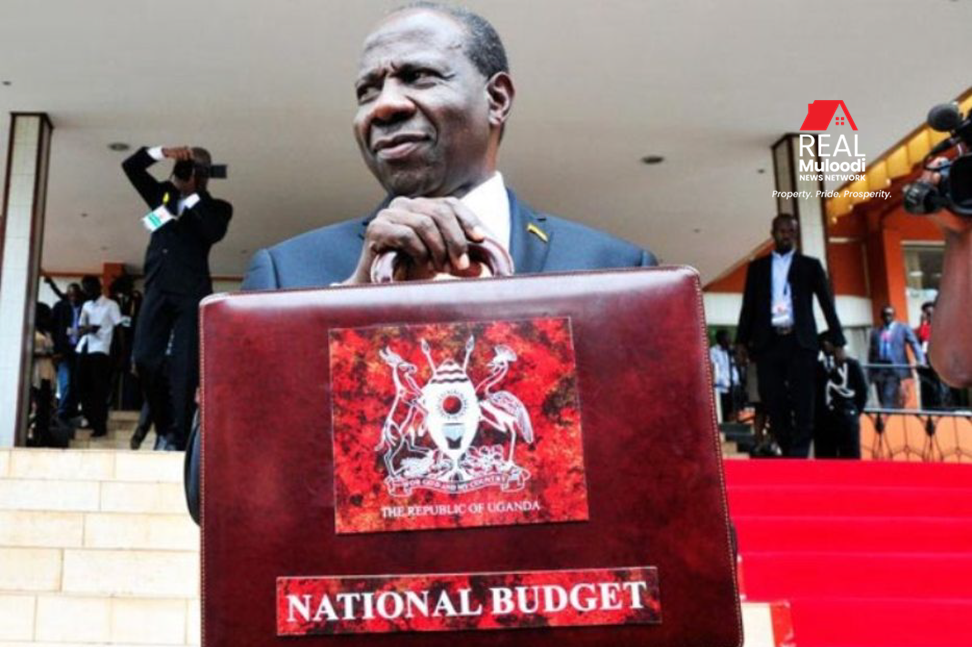

UGANDA, Kampala | Real Muloodi News | Permanent Secretary of the Finance Ministry, Ramathan Ggoobi, has announced that there will be no new borrowing in the next fiscal year to minimise Uganda’s debt burden.

The country’s debt stock increased to UGX86.6tn ($23.8bn) as of June 30, 2022, compared to UGX75.1tn in the previous year, a rise of 12.5%.

The debt is split between UGX38.1tn of domestic debt and UGX48.5tn of external debt. This is a worrying trend, as it represents an increase of 104% over the past five years, driven primarily by new debt, which has put pressure on the economy and led to more borrowing from the domestic market.

As a result, Uganda’s public debt is unsustainable in the short term, and experts warn that continued reliance on Net Domestic Financing (NDF) signals the government’s borrowing appetite.

Uganda’s Auditor General, John Muwanga, warns that borrowing costs could make payments unsustainable for the country.

The major cause of the increase in borrowing is the contraction of new loans, mainly for budget support.

The Ugandan government is also facing a persistent budget deficit, meaning that government revenue is lower than its expenditure. This deficit is leading to the rollover of liquidity papers, bond switches, and private placements.

Muwanga adds that foreign exchange loss arising from the depreciation of the Ugandan Shilling against stronger currencies is also a significant factor in the increase in Uganda’s public debt.

The high level of Uganda’s public debt also raises concerns about its Debt-to-GDP ratio. This ratio compares a country’s total debt with what it produces, and a high ratio may make it more difficult for a country to pay back its debts.

The International Monetary Fund (IMF) recommends that developing countries, such as Uganda, maintain a Debt to GDP ratio below 50%, while many developed countries have gone up to 200%.

However, Uganda’s Debt to GDP ratio increased by 21% from 31% to 52% over the past five years, which is worrying.

Undisbursed loans in Uganda stood at UGX15.6tn ($4.3bn) in the 2021/22 fiscal year, which was responsible for high commission fees on acquired loans that were yet to be disbursed. This failure to draw down and low absorption of contracted government debt continues to affect service delivery.

Uganda’s external debt as of June 30, 2022, is made up of UGX29.9tn ($8.2bn) of multilateral creditors, UGX13.5tn ($3.7bn) of bilateral creditors, and UGX5tn ($1.4bn) of commercial banks.

The linear growth in the level of external debt in the past five years has led to a consistent increase from UGX28.4tn in the 2017/18 fiscal year to UGX48.4tn in 2021/22, representing overall growth of 70.6%.

Uganda’s dependence on debt rollover to finance matured/redemption instruments is creating a high dependence on the market, increasing refinancing risk.

The Ugandan government’s continued reliance on Net Domestic Financing affects growth in the private sector as market players demand increased rates, aware that the government is in dire need of financing the budget.

To address the rising debt, the Ugandan government is focusing on repurposing its budget, given its constrained resources.

The Ministry of Finance has established new fiscal policy guidelines to minimise the share of Uganda Revenue Authority URA revenues used to service debt.

The government will suspend borrowing over the short-to-medium term to ensure more resources are available to address immediate and pressing needs such as providing healthcare, supporting businesses, and improving infrastructure. This decision is often taken when the government is facing a significant fiscal deficit, where the amount it spends exceeds the amount it receives in revenue.

Suspending borrowing over the short-to-medium term means that the government will not issue any new debt instruments such as bonds or treasury bills.

Instead, it will rely on its existing revenue streams to finance its operations and meet its expenses. This decision can have both positive and negative effects on the economy.

On the one hand, it can help to reduce the fiscal deficit and the overall level of government debt, which can have a positive impact on investor confidence and can help to stabilise the economy in the long run.

On the other hand, suspending borrowing can also lead to a reduction in government spending, which can harm the economy, especially if the government is cutting back on vital public services such as education, healthcare, and social welfare.

Moreover, suspending borrowing can also limit the government’s ability to respond to unforeseen events such as natural disasters or economic shocks.

In such cases, the government may need to borrow money to finance its emergency response and recovery efforts.

Overall, the decision to suspend borrowing over the short-to-medium term requires careful consideration of the economic and social implications.

While it can help to reduce the fiscal deficit and overall debt burden, it can also harm the economy and limit the government’s ability to respond to unexpected events.

READ MORE LIKE THIS: