UGANDA, Kampala | Real Muloodi News | According to preliminary statistics from the Bank of Uganda in October last year, Uganda’s public debt has increased to 73.8 trillion shillings (about 20.8 billion US dollars).

The Ministry of Finance, Planning, and Economic Development estimated that the public debt increased far more than a quarter to 69 trillion shillings (19.5 billion USD) by the end of June 2021.

The spike from the end of June to the end of October last year was primarily due to the government’s acquisition of 5.9 trillion shillings in public debt. Given the current population projections from worldwide demographic centres, this equates to 1.53 million shillings in government debt for every Ugandan. According to Macrotrends.net and Worldometers.info, Uganda’s population was 48 million last Thursday.

According to the ministry, the Covid-19 problem, which has aggravated Uganda’s budgetary situation and developmental demands, is blamed on the rapid increase in the national debt stock.

In October 2021, the overall foreign debt risk, the existing stock of disbursed debt and pledged debt but not yet disbursed, stood for 62% of the entire government debt.

The total stock of disbursed foreign debt was 12.8 billion dollars, with 4.3 billion still due.

Increased funding assistance flows from international lenders were principally responsible for the growth in disbursed external debt. The World Bank’s International Development Association (IDA) whose outstanding loan to Uganda is now 4.5 billion, and the African Development Fund (ADF) which receives project assistance mainly from the African Export-Import Bank, were involved.

China is Uganda’s largest international creditor, with a loan of $2.55 billion, followed by Japan and the United Kingdom.

The country’s leading private lenders to the government are Afrexim Bank, Stanbic, and Standard Chartered Bank.

While official data suggest the total debt to GDP ratio is slightly less than 50%, economists argue this does not provide the complete picture.

According to the Uganda Debt Network (UDN), the figures only reflect debt acquired mainly through loan requests, leaving out other government financial responsibilities such as legal fines and penalties, compensations, and other commitments, which push the number beyond 50%.

UDN further cautions that the load is increasing not just due to additional loans but also as a result of increased financing costs.

“The average interest rate on external debt increased to 1.4 percent in 2020 from 0.8 percent previously, mainly as low-cost term loans reduce alongside a reduction in the grant element in the new loans. The average repayment period is also reducing,” said UDN in a statement.

The lobbying organisation emphasises the need of focusing on domestic revenue mobilisation by broadening the tax base, leveraging digital technologies to increase collection levels, fixing leakages, and reallocating public expenditure to better priorities.

According to the Ministry of Finance, Uganda’s debt is manageable and among the safest in the area.

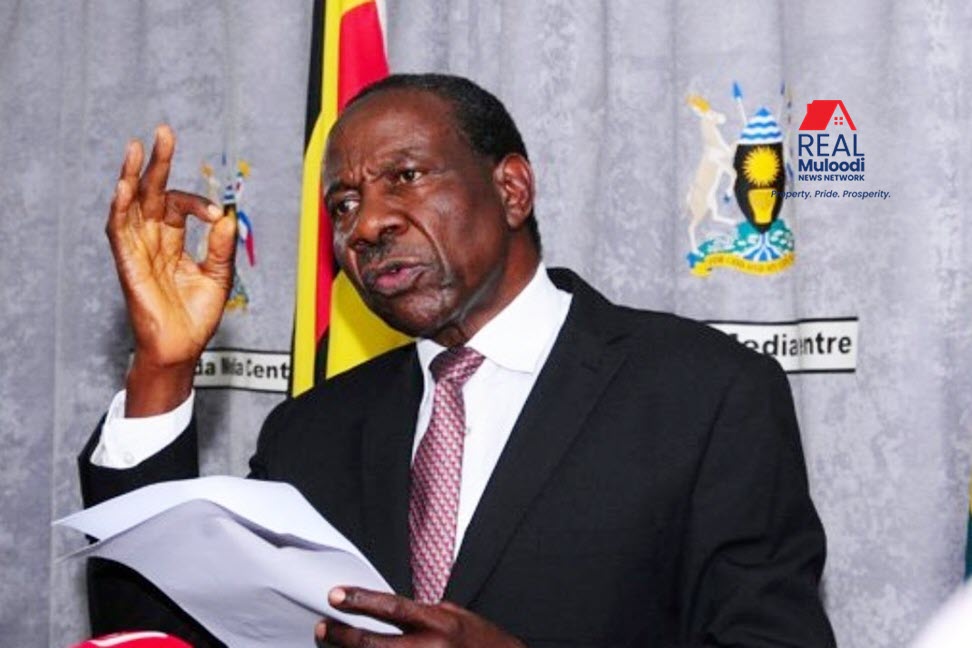

“Some people have portrayed a picture that Uganda has over-borrowed. That’s not true. Our Debt-to-GDP ratio is amoung one of in the region, but we want to keep it within our Chatter of Physical Responsibility which we have already gotten through parliament,” says Ramathan Ggoobi, the Permanent Secretary at the Ministry of Finance.

Ggoobi claims that they would seek further concessional loans.

“We are going to borrow largely concessional or longer-dated commercial in order to reduce the refinancing risk,” he says.

Finance Minister Matiya Kasaija attributed the debt growth on repeated additional budgets, some of which he said could be prevented, in his remark on the start of the 2022/23 budget process.

“How do you bring a supplementary budget request for an international conference which you have expected to host for two years?” he wondered.

READ MORE LIKE THIS:

Gov’t Will Minimise Borrowing to Increase Banks’ Appetite to Lend to Locals

Govt Increases URA Collections Target; How URA Plans to Meet It