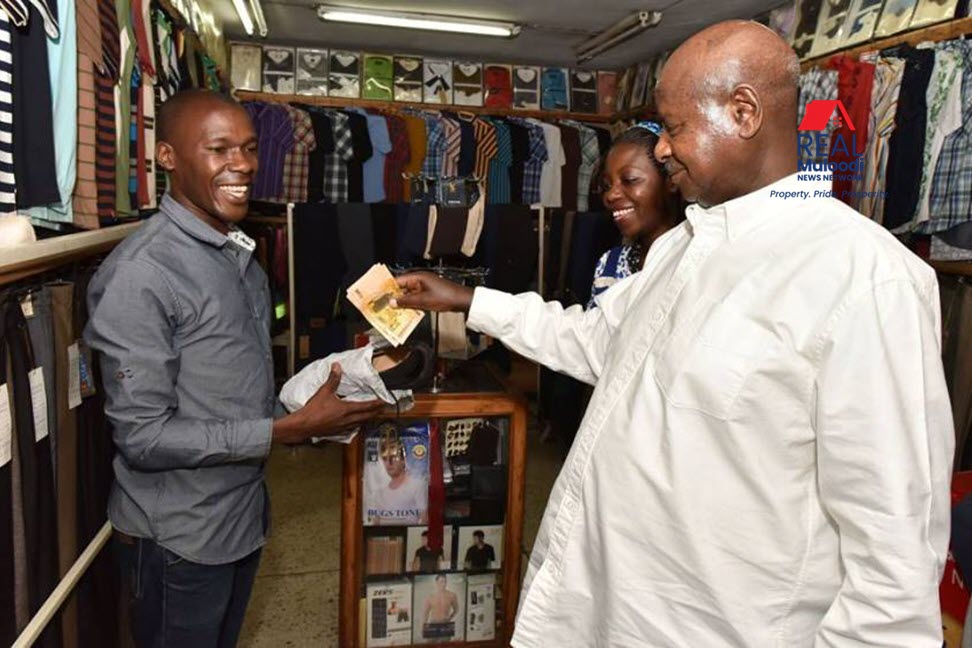

UGANDA, Kampala | Real Muloodi News | Micro and Small-scale entrepreneurs will have to wait a little longer before accessing the UGX 200Bn relief package promised by the President. The government says it is still working on the modalities of managing the cash to avoid past mistakes.

About a month into the second COVID-19 lockdown, the President announced the relief package worth UGX 200Bn following an outcry from small-scale entrepreneurs.

The small-scale entrepreneurs raised concern that they might lose their livelihood since the lockdown shut their businesses. The lockdown between June and August 2021 left many businesses crippled.

The President’s statement specified micro, small and medium enterprises as the major beneficiaries of the UGX 200Bn relief package. However, the concerned ministries have since revised the package offer to target small enterprises.

According to Patrick Ocailap, the Secretary to the Treasury, the funds will be given to small enterprises since all the previous funds had gone to micro, medium and large enterprises.

“These are enterprises which employ five to 30 people, but others can be sole proprietors. They usually have a turnover of between five and 100,” says Ocailap.

Ocailap explains that the government has taken longer than expected because there is a lot to do in planning for the money to avoid any hiccups, which characterised the previous fund distribution.

Ocailap says most commercial banks, including Post Bank, Housing Finance and Pride Microfinance, applied to take part in the fund distribution.

The participating banks expect to raise the 100 billion Ugandan shillings while the government raises the other 100 billion. They also have to compile a list of beneficiaries and the interest rates for the money.

The ministries and business community leaders have agreed that this money should not pass through the Uganda Development Bank or the Microfinance Support Centre because of the bureaucracy involved in the two institutions.

The State Minister for Microfinance, Haruna Kasolo says although the government created this relief fund as an emergency fund, the category of people targeted might not meet the requirements like those of the other scheme, Emyooga.

Kasolo further explains that Emyooga funds distributed through SACCOs targeted people already working and had savings.

Paying back the funds is an issue being discussed by the authorities since the targeted beneficiaries might not have the security needed by the commercial banks.

According to the Chief Executive of the Uganda Small and Medium Enterprises Association, John Walugembe Kakungulu, although relief funds distribution is taking long, they agree with their decision.

Walugembe says that channelling the funds through commercial banks and giving them to individual beneficiaries is better than using SACCOS.

READ MORE LIKE THIS:

City Traders Ignorant about Presidential Stimulus Package to Boost Their Businesses