UGANDA, Kampala | Real Muloodi News | Property owners in Uganda express their frustration with the Uganda Revenue Authority (URA) over communication issues and perceived challenges related to rental income taxes.

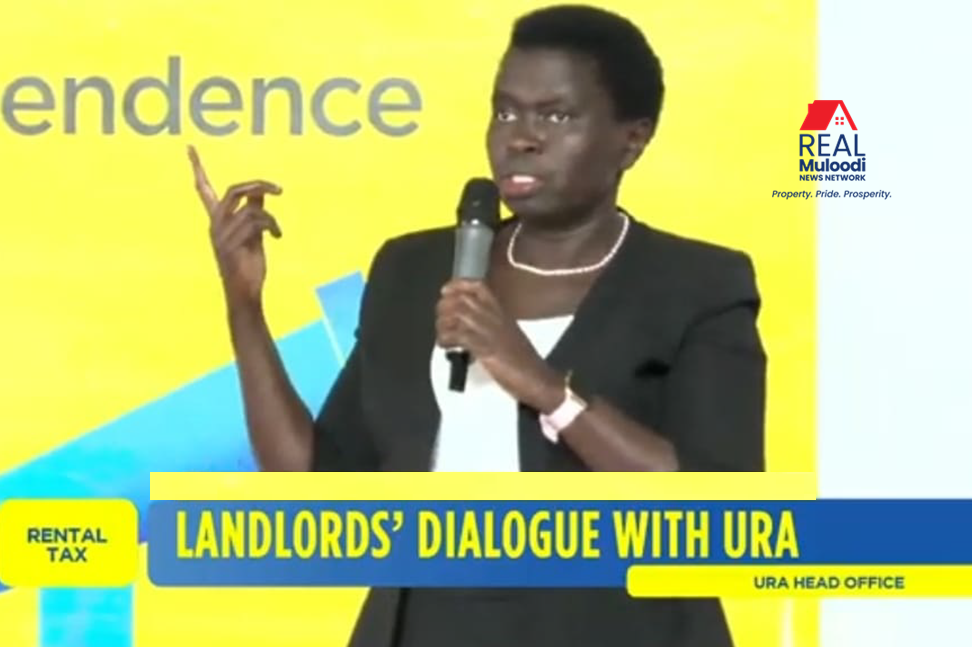

During a recent meeting held at the URA headquarters in Kampala on September 27, property owners raised their concerns with Commissioner General John Musinguzi Rujoki and other URA officials.

The landlords were calling for improved communication and more flexible tax solutions to better address their needs and concerns while ensuring compliance with tax obligations.

This comes after an increasing number of landlords have been caught by surprise by the taxman, having been identified by URA’s newest intelligence tool, the Rental Tax Compliance System (rTCS).

Ismael Bwekwaso, a property owner, questioned why the URA collected their contact information but failed to respond to their inquiries.

He stressed the importance of better communication channels to address tax-related complaints effectively, emphasising that dialogue is crucial for resolving tax issues and fostering the country’s development.

Meanwhile, URA Commissioner Domestic Taxes, Sarah Chelangat also clarified the rental tax rates, indicating that individuals were required to pay a 12% rental income tax, while companies were subject to a 30% annual tax rate.

The landlords also called on the URA to reconsider its approach to collecting rental income taxes.

They criticised the agency’s perceived heavy-handedness, particularly when demanding taxes from property owners.

Bwekwaso pointed out that property management often relies on suppliers who provide goods on credit, and having accounts closed due to non-payment of rental income taxes is seen as unfair.

During the meeting, attended by over 2000 property owners from Kampala, Commissioner General Musinguzi acknowledged any past mistakes made by the URA and pledged to improve relations with landlords.

However, he also reminded property owners of their tax obligations.

Property owners further requested tax holidays, taking into account the challenges faced by businesses in the post-COVID-19 era.

They advocated for alternative dispute resolution mechanisms to address critical issues related to tax remittances.

Responding to concerns about the lack of response to landlord complaints, Musinguzi advised property owners to utilise alternative communication channels to seek assistance, acknowledging that personally addressing a high volume of daily calls would be impractical.

READ MORE LIKE THIS:

URA Strengthens Ties with Landlords to Enhance Tax Compliance

URA Launches Voluntary Disclosure Program for Landlords to Encourage Tax Compliance

URA Invites Landlords of Commercial Buildings for a Tax Engagement