UGANDA, Kampala | Real Muloodi News | The Uganda Revenue Authority (URA) is taking steps to boost rental tax collections in the Kampala Central Business District by introducing a Voluntary Disclosure Program for landlords to help them avoid penalties that arise from non-compliance.

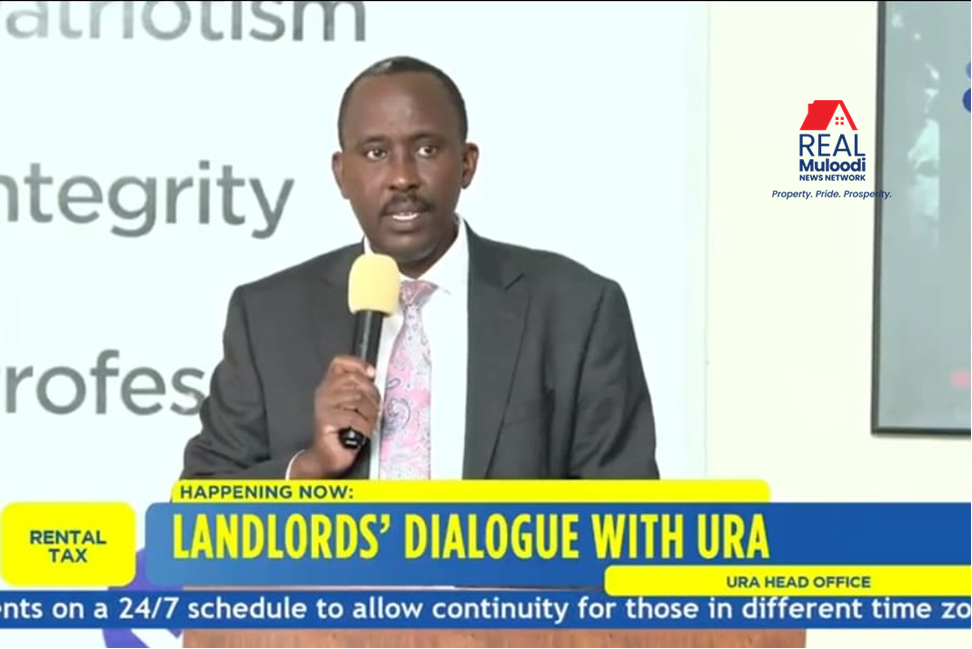

During a tax engagement session between the URA officials and the city landlords which was held on Wednesday, 27th September 2023 at Sendaula Hall, URA headquarters in Nakawa, the URA Commissioner General John Musinguzi expressed concern about the low levels of compliance among city landlords, despite technological improvements in rental tax collections.

He encouraged those with outstanding tax payments to utilise the interest waiver opportunity, which expires on December 31, 2023, under the voluntary disclosure arrangement.

Musinguzi emphasised the need to reconsider the strategy and engage directly with rent-paying individuals to enhance tax compliance, as inefficiencies in this tax category negatively impact both URA and the country’s revenue.

“Let us rethink the strategy; we can only succeed if we go to the people that pay this rent because URA is suffering as well as the country because of inefficiency with this tax head,” Musinguzi said about finding solutions to improve rental tax collections.

In the last fiscal year, URA successfully collected USh215.10 billion in rental tax, surpassing the target of USh171.09 billion, achieving a performance rate of 125.72%.

However, URA believes that rental tax collections could improve further if all property owners complied.

Musinguzi said that USh1 trillion is expected from only rental income tax collections and to hit this target, URA has enlisted the support of business leaders to help identify non-compliant property owners.

URA plans to conduct a headcount exercise to determine the number of commercial buildings in the city, collaborating with the Kampala Capital City Authority (KCCA) and using the new intelligence system the Rental Tax Compliance System (rTCs) to ensure accurate coverage of and data integration.

“We shall consult KCCA to provide us with the lists of the commercial buildings so that the officers in the field will be ticking off the list to ensure all of them are covered,” Musinguzi noted.

During the meeting, business leaders were told to provide URA with information on the actual rent paid by tenants, which some landlords allegedly conceal with fake receipts.

URA will also conduct a tax education engagement with commercial building owners per division to address information gaps that may hinder compliance.

Property owners were introduced to the Voluntary Disclosure Program, allowing those in default a grace period to comply.

However, URA emphasised that for those who do not comply within the specified timeframe, the authority will apply the full force of the law to ensure tax compliance.

“For those who won’t comply, URA will apply the law,” Musinguzi emphasised.

READ MORE LIKE THIS:

URA Invites Landlords of Commercial Buildings for a Tax Engagement

URA Targets Landlords with New Computers and Sophisticated Software