UGANDA, Kampala | Real Muloodi News | Are you wondering why the world’s wealthiest billionaires are becoming richer since the pandemic started and not the reverse? Most people can’t comprehend what it’s like to be a member of the global billionaire class.

Billionaires’ proportion of wealth increased at the fastest rate on record in 2021, according to the World Inequality Lab’s annual World Inequality Report. Billionaires have collected more money than ever before, rising from 1% in 1995 to 3% in 2021. A 1% return on a $1 billion investment would result in a yearly interest payment of $10 million without ever touching the principal.

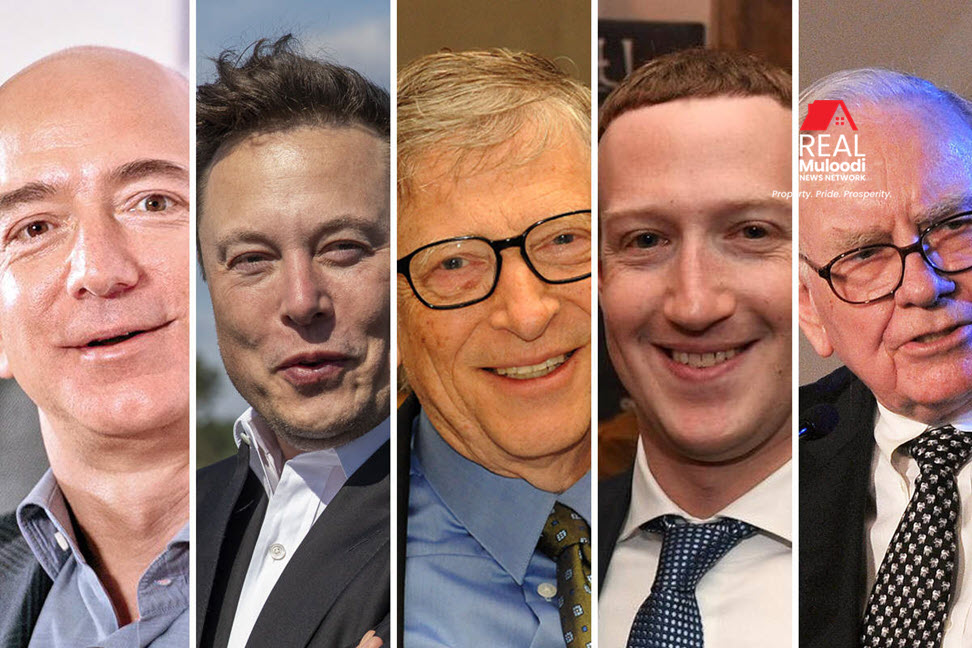

When we mention the world’s wealthiest billionaires, Jeff Bezos, Mark Zuckerberg, Bill Gates, Aliko Dangote, Naguib Sawiris, Warren Buffet, Larry Ellison and Elon Musk, who is currently the world’s richest man are all household names.

So, what keeps the world’s renowned wealthiest billionaires richer even when cash flow is tight and poverty is rife for the rest of the globe? Let’s take a peep at these various yet common business ventures the world’s wealthiest billionaires invest their money in to stay rich.

Real Estate

For many years, the world’s wealthiest billionaires have preferred real estate investing as the most excellent way to keep their money. Initially, a principal residence is acquired, followed by other rental properties. After purchasing some residential properties, they have moved on to commercial properties such as hotels, stadiums, and office complexes.

Many billionaires hold substantial real estate portfolios, including Larry Ellison. In recent years, Ellison has progressively increased his real estate holdings, amassing a portfolio worth more than $1 billion.

This is similar to real estate muloodis like Hamis Kiggundu and Sudhir Ruparelia who are ranked as the richest Ugandans and have amassed wealth venturing into real estate.

Real estate agents will offer opportunities, and financing will become smoother once these billionaires have identified themselves as investors.

Extensive investors put millions of dollars into real estate. Real estate is not a cash-flowing investment, but it is a good one for a lengthy period and is a tried-and-true investment for billionaires since it generates passive income.

According to sources, Elon Musk, worth $151 billion, the CEO of Tesla and SpaceX, owned lots of residential properties before he recently sold all of them in a weird attempt to own no home. Aside from his shares in his different companies and other business ventures, Elon Musk has also amassed unimaginable wealth through the sale of his homes making him the richest man alive today.

Commodities

Commodities, such as gold, silver, mineral rights, and livestock, are not only sources of wealth but also inflation insurance.

Egyptian billionaire Naguib Sawiris has established a $1.4 billion fund to hold his gold mining interests which he ventured into earlier in 2021 and chase new chances in the sector, which he claims demands consolidation.

Aliko Dangote, Africa’s richest man, has a significant stake in cement and sugar, salt, oil, fertiliser, and packaged food.

Cash and Cash Equivalent

Billionaires are known for being stingy. They don’t usually overspend since it prevents them from amassing more wealth. They spend on needs and a few extras, but they also save and encourage their family members to do so. Bill Gates, Aliko Dangote, and Warren Buffet are among the billionaires who hold their money in liquid assets forms or cash equivalents.

Before they invest, billionaires set up emergency funds. They have cash equivalents on hand, nearly as liquid as cash. Forms of cash equivalents are money market mutual funds, deposit certificates, commercial paper, and Treasury bills.

Global Equities and Stock Funds

Although many billionaires trade in the stock market, we must remember that they are in a unique situation than the rest. One factor is that they have the financial means to take more significant risks. A complete investment loss is unlikely to jeopardise their future financial stability or comfort. They can take on more significant risks since they have so much money.

Ultra-wealthy investors may control one or more essential corporations. Many billionaires, on the other hand, only own a few stocks. Index funds are popular among investors because they provide good returns and do not need management. They are also well-diversified and have moderate management costs.

Billionaires are drawn to return on capital stocks that provide passive income. With capital increment, some investors are more interested in creating cash flow than capital growth.

Bill Gates has received more than $50 billion in dividends and share earnings since 2004, along with a $3.3 billion payment from Microsoft, where he owns around 1% of the corporation.

Crypto

Steven Cohen, Ray Dalio, and Elon Musk, the world’s richest man venture in Bitcoin, Ethereum, and Dogecoin

Since 2011, Bitcoin has grown by more than 20,000,000%, giving it one of the most successful financial assets ever.

If you want to earn money in cryptocurrency, you must be prepared to take substantial risks.

However, some billionaires, such as Warren Buffet and James Dimon, have refused to venture into such business risks of investing their hard-earned money in bitcoin and other digital currencies.

Despite this, only a small percentage of the world’s wealthiest people engage in such transactions since they are risky.

Private Equity and Hedge Funds

This type of investment won’t be lucrative unless you are extremely rich.

Private equity and hedge funds are distinct. Hedge funds combine money and employ various methods to generate high returns for their investors. Fund managers choose hedge funds because they will yield more considerable short-term earnings.

On the other hand, private equity funds are typically invested by huge organisations like universities or pension funds.

A qualified investor might be an individual or a business, but they must follow specific guidelines. Public equity funds are subject to more effective regulations than private equity funds in particular ways. If they qualify, some ultra-wealthy investors participate in private equity.

Alternative Investments

Some billionaires put a part of the money into beautiful art, musical instruments, and unique stamps, among other things.

In addition, the ultra-wealthy possess intellectual property rights to songs and films. Such ventures can be quite profitable.

David Geffen, the owner of DreamWorks Animation, owns $1.1 billion in art. He allegedly sold four modern artworks from his collections for $421 million in 2006.

Meanwhile, Wealth-X, Jackson Pollock’s “Number 5, 1948” sold for $140 million, and Willem de Kooning’s “Woman III” sold for $137.5 million.

Summing up, billionaires have a wide range of investing views, making it impossible to generalise where they put their money. All of the above are viable investments for the world’s richest individuals.

Many of them choose diverse portfolios to lessen the risk of their investments, so investing in many sectors will boost your wealth.

READ MORE LIKE THIS:

Battle of the Real Muloodis in the Sports Stadium Arena: Rajiv Ruparelia vs. Hamis Kiggundu

Property Investment Remains a Valuable Wealth-Creation Strategy