UGANDA, Nakawa | Real Muloodi News | The KCCA Valuation Court has initiated its sessions in Kyanja Parish, Nakawa Division, marking a significant move to address property tax concerns for residents.

The court, chaired by Samuel Muyizzi Mulindwa and endowed with powers akin to a Magistrate’s court, has been established to handle issues related to property taxation.

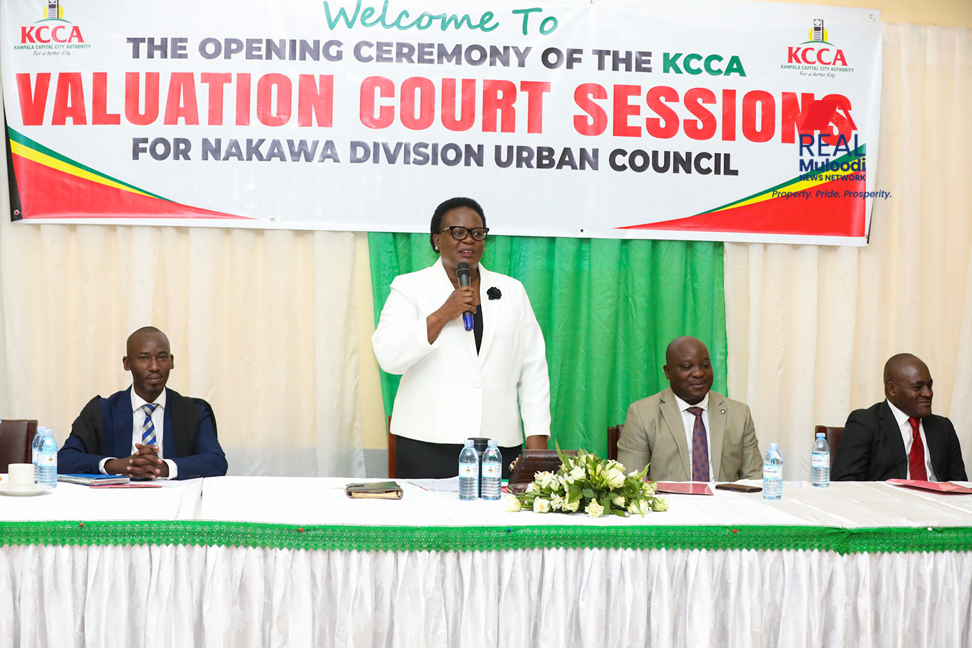

Opening its first session at Kisaasi Community Health Center in Kyanja Parish Nakawa Division, the court was inaugurated by Kampala City Lord Mayor Erias Lukwago.

Lukwago emphasised the court’s role, mandated by law to protect local citizens from unfair tax practices. He outlined that, following valuation, the court has the authority to potentially reduce tax rates based on the merit of complainants’ arguments, urging property owners with grievances not to endure them silently.

Lukwago elucidated the property tax payment bands, indicating that individuals earning over UGX 5 million per annum on their property pay a 6% tax rate.

Those earning between UGX 3 million and UGX 5 million pay 4%, while those not earning more than UGX 3 million from their commercial houses in a year will be charged a reduced rate of 1%. This progressive approach aims to ease the financial burden on smaller property owners.

Chairperson Muyizzi emphasised the urgent need for increased financial support for the court due to the overwhelming number of cases, citing over 1500 objections from Nakawa alone.

He called for legislative amendments, proposing an extension of the hearing period for complaints beyond the current six months, considering the court handles at least 20 cases daily.

In a move towards transparency, the Valuation Court has launched a dedicated website where all rulings will be uploaded and made accessible to the public. This initiative is designed to foster accountability and keep stakeholders well informed about the proceedings.

Deputy Mayor Salah Mutoni of Nakawa Division expressed support for the court’s efforts on the ground, encouraging locals to embrace the process and stay informed about their property tax matters.

Councilor Bonny Katongole, representing Kyanja II and Kisaasi Central, expressed satisfaction with the court’s outreach, stating, “I’m happy that the court has come to the people to listen to their grievances. There have been a lot of complaints and questions, and we did not have answers.”

READ MORE LIKE THIS:

Property Tax: KCCA Approves Valuation Court to Hear Complaints