UGANDA, Kampala | Real Muloodi News | The Commissioner General of The Gambia Revenue Authority (GRA), Mr. Yankuba Darboe, undertook a meticulous operational assessment tour in Uganda last week, with technology company RippleNami Inc.

The objective of the visit was a benchmarking exercise to evaluate the Rental Tax Compliance System (rTCS), developed by RippleNami and deployed by the Uganda Revenue Authority (URA) in April of last year.

The technical committee lead by Darboe included eleven government representatives from the Ministry of Finance and Economic Affairs (MoFEA), Ministry of Local Government and Lands (MLGL), and GRA.

The delegation sought to evaluate Uganda’s procurement process of the system, and to gain insight into its benefits, challenges, and potential, as well as the experiences of URA and other users.

Esther Ssemakula Nabatanzi, the Ag. Manager Rental Tax at URA, provided a comprehensive overview of the state-of-the-art technology, outlining its sustainability, institutional and legislative support, and successes since its implementation.

The work to implement rTCS in Uganda commenced in October 2020. Following an extensive phase of data input from eight participating Ministries, Departments, and Agencies (MDAs), along with thorough data cleansing, matching, and analysis, the system became operational in April 2022.

The Gambia is poised to adopt the technology, after RippleNami emerged as the successful bidder to supply The Gambia Revenue Authority with a rental income mobilization system through a Public-Private Partnership (PPP) procurement arrangement.

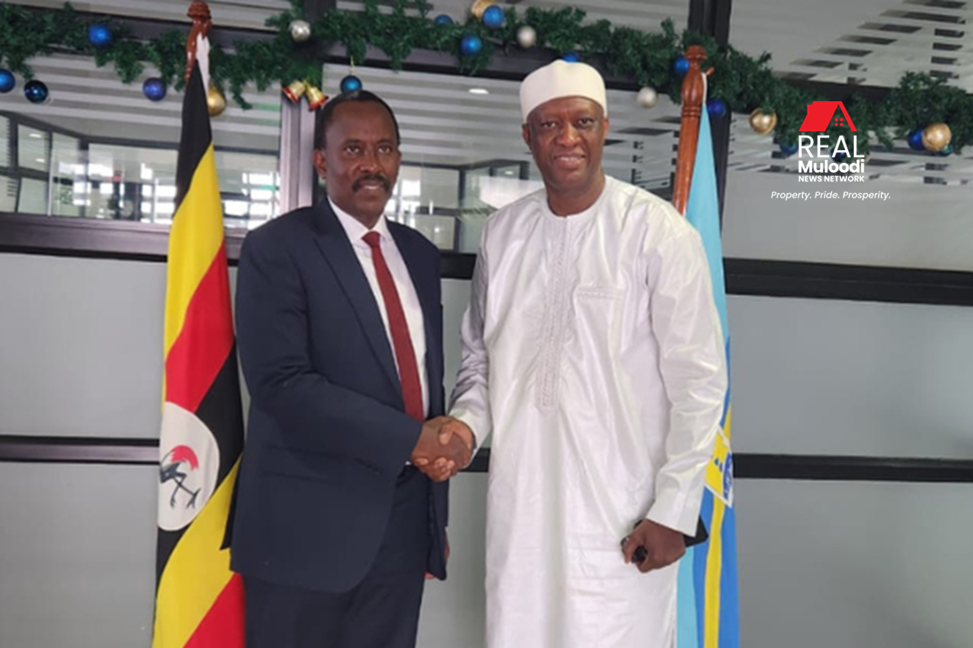

In his remarks, URA Commissioner General John R. Musinguzi emphasised the value of knowledge exchange for the technological advancement amoung African nations, asserting that such exchanges contribute to economic growth, development and liberation.

“I appreciate the fact that organisations can learn from each other through sharing ideas, and that it is through this that countries can be delivered from donor dependency,” said Musinguzi.

Yankuba Darboe expressed gratitude to URA for providing a valuable platform for mutual learning and comparison of systems, and thanked his Ugandan counterpart for the warm reception and continuous support extended to GRA.

“I appreciate the partnership and relationship we share, and it has yielded results through learning to enhance our technology since we are moving from manual processes to automation,” said Darboe.

The GRA has a fruitful history of benchmark visits review various URA systems, including the Digital Tracking Solution and the Regional Electric Cargo Tracking System.

After the GRA delegation witnessed the Rental Tax Compliance System in action, the Gambia Revenue Authority affirmed its intent to acquire the system. This strategic move aligns with GRA’s objectives of boosting rental income and fortifying its revenue base.

READ MORE LIKE THIS:

URA Strengthens Ties with Landlords to Enhance Tax Compliance

URA Extends Olive Branch: Waives Interest and Penalties for Landlords

URA Mandates E-receipts for City Landlords to Tackle Tax Evasion